Affordable Housing FAQs

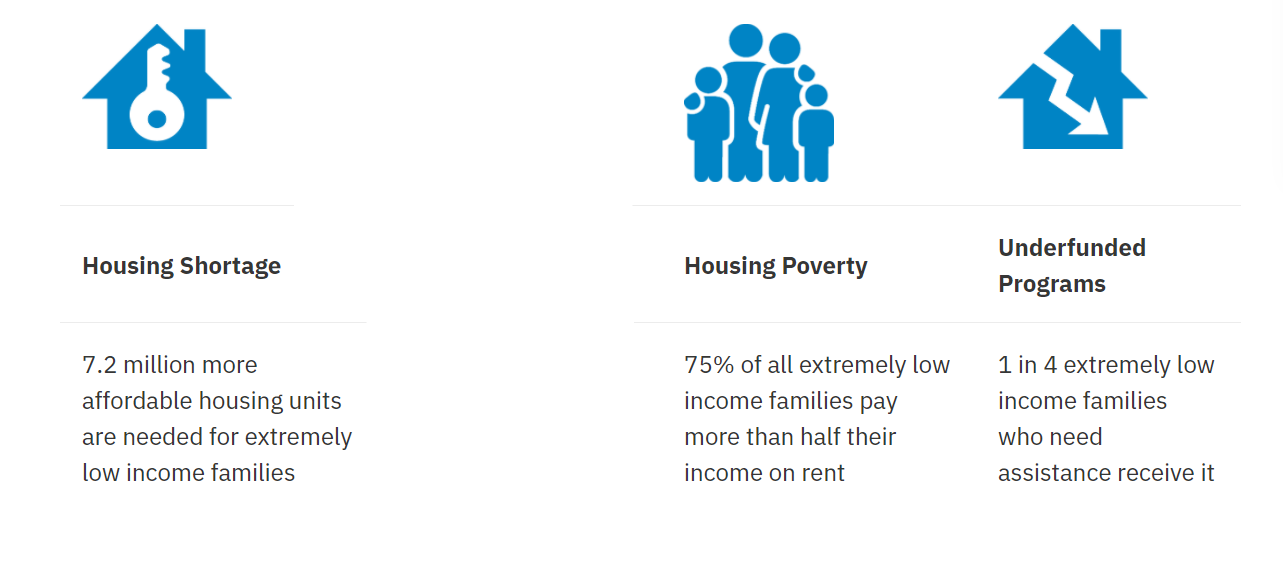

There is a shortage of rental homes affordable and available to extremely low income households (ELI), whose incomes are at or below the poverty guideline or 30% of the area median income (AMI). Many of these households are severely cost burdened meaning they are spending more than half of their income on housing. Severely cost burdened households are more likely than other renters to cut back on necessities like healthy food and healthcare to pay the rent and thus experience unstable housing situations, including evictions.

What economic challenges do families in the area face?

Many families in Montgomery County and surrounding communities are challenged by poverty and other barriers:

- 6.9% of the population (72,305 people) live on incomes that are below the Federal Poverty Line

- 21.8% of families are below 300% of the Federal Poverty Line

- 14.9% of female-headed households with children under 18 are living in poverty

- 53.2% of residents living in poverty (age 5 or older) speak a language other than English at home

Liquid Asset Poverty: 24.5% of households are without sufficient liquid assets to subsist at the poverty level for three months in the absence of income

- Zero Net Worth: 13.2% of households have zero or negative net worth

- Unbanked: 1.8% of County households do not have a checking or savings account – 13% of these households are white, 19.6% are Asian, 41.8% are Black, and 52.1% are Latino

What housing challenges confront our neighbors?

Living in the high-cost DC metropolitan area, many are considered “housing burdened,” meaning they spend more than 30% of income on housing:

- 46.8% of all renters are housing burdened

- 40% of white (non-Hispanic or Latino) renters, 37.8% of Asian renters, 63% of Hispanic or Latino renters, and 53.2% of Black or African American renters are housing burdened

- 85% of households with annual incomes of less than $50,000 are housing burdened

Resources: